current information...

CORNER FOR APARTMENT

AND HOUSE FOR RENT OWNERS

Here you will find all the key information to help you make the most of your property. From legal obligations to promotion tips, we aim to provide you with the tools and resources you need to successfully manage and rent your space.

E-visitor system

If you do not have data for the E visitor system:

Exceptionally, you can send your personal data, OIB and title deed, scanned in pdf format or photographed, to e – mail adress info@visit-omisalj-njivice.hr.

When sending an e-mail, please write a personal statement in the e-mail in which you allow the Omišalj Municipality Tourist Board to open your E-visitor account and use your personal data for this purpose with an electronic signature, i.e. your first and last name.

TIC Omišalj

- Prikešte 11, 51511 Omišalj

- +385 51 841 042

- info@visit-omisalj-njivice.hr

- www.visit-omisalj-njivice.hr

Working hours:

MON - SAT: 8:00-21:00

SUNDAY: Closed

BREAK 11:00-11:30

Njivice office

- Placa 9, 51512 Njivice

- +385 51 261 083

- info@visit-omisalj-njivice.hr

- www.visit-omisalj-njivice.hr

Working hours:

MON - SAT: 8:00-20:00

SUNDAY: 08:00-13:00

BREAK 11:00-11:30

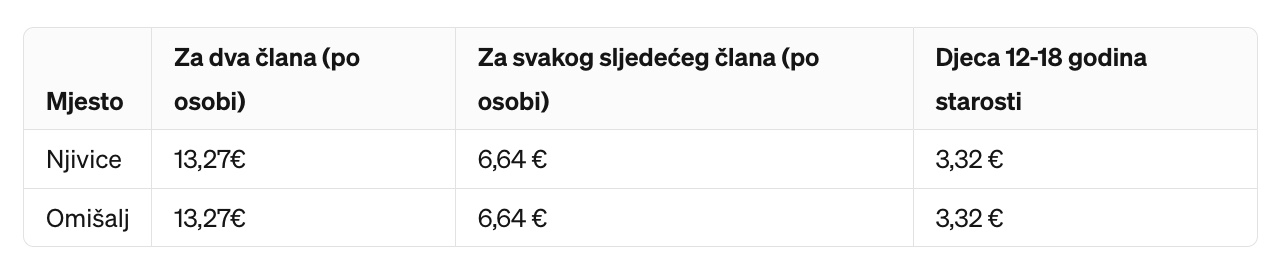

WHO PAYS THE FEE?

The owner of a holiday house or apartment, as well as all persons staying in that house or apartment, must register their stay during the period of the main tourist season, from June 15 to September 15, within 24 hours of arrival, and check out on the last day of their stay your stay.

For foreign citizens, the obligation to register remains throughout the year (except member states of the contracting parties to the European Economic Area), in accordance with the provisions of the Law on the Movement and Residence of Foreigners.

From 01.01.2016. registration and de-registration of owners of houses and apartments for vacation and all persons staying in them are possible exclusively through the eVisitor system.

Owners of holiday homes and apartments must register themselves and all persons staying in their facilities directly in the system via the Internet.

According to the Tourist Tax Act (Official Gazette 52/2019), the tourist tax is paid by the owner of a holiday house or apartment in a tourist destination and all persons staying in that house or apartment. Any building or apartment that is used seasonally or occasionally is considered a vacation home or apartment.

The owner of a holiday home or apartment in a tourist destination pays the tourist tax when they stay in a holiday home or apartment in a tourist destination during the main season (June 15 to September 15).

WHO DON'T PAY TAX?

(1) As an exception to Article 4 of this Act, the tourist tax shall not be paid by:

children up to 12 years old

persons with a disability of 70% or more and one companion

persons who, due to the need to work or perform tasks, use the accommodation service in a municipality or city where they do not reside, exclusively during the performance of tasks/work

professional crew members on charter vessels and multi-day cruise ships

participants of school package-arrangements with accommodation included, approved by school institutions

persons who use the overnight service within the framework of exercising the right to accommodation as beneficiaries of social welfare i

students and pupils who do not reside in the municipality or city where they are studying when they stay in an accommodation facility in that municipality or city.